You are now leaving the Chase Investment Counsel website and entering the Chase Growth Fund website.

Understanding Capital Gains

The act of investing – putting aside money today and buying an asset like a house, or stock – generally has one main goal in mind – capital gains. Capital gains can apply to any type of asset: a home, a stock, a bond and even a collectible like a rare coin. When an asset is purchased and goes up in value, the owner has a capital gain. When an asset is purchased and goes down in value it has what is known as a capital loss. There are four key terms that investors need to understand regarding capital gains and losses: realized, unrealized, short-term and long-term.

Most of you have heard the phrase “paper profits.” If you buy an asset and it goes up in price you have an unrealized capital gain. It is only “realized” when the asset is sold. The same is true for losses. Short-term and long-term simply refer to the length of time the asset has been held. A short-term gain is one on an asset owned for one year or less while a long-term gain is one on an asset owned for longer than one year. The most common types of capital gains (and losses) most of us will deal with regard home ownership and investments like stocks, bonds, and mutual funds. We are going to focus our attention here on capital gains related to stocks and other securities.

Capital Gains Explained

When talking about capital gains and capital losses, the key tax issue to focus on is whether they are short-term or long-term. Short-term gains and long-term gains (and losses) are treated differently for tax purposes. There is also something called the “wash sale” rule, which could negate a capital loss and which we will explain later. Finally, what happens if your capital losses in a year exceed your capital gains? We’ll take a look at all of these items to make sense of them.

Short-Term Capital Gains

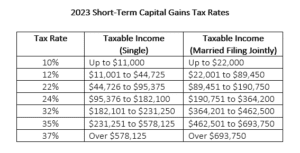

As noted, an asset held for one year or less is said to be short-term. If you sell that asset and experience a gain on the sale, you are taxed at the short-term capital gains tax rate. Short-term capital gains are taxed at the same rate as ordinary income. There is no tax benefit given to short-term assets. Ordinary tax rates range from 10% to 37%.

Long-Term Capital Gains

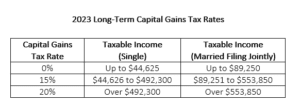

An asset that is held for more than a year is said to be long-term. An asset that is sold and was held for a long-term holding period is subject to long-term capital gains tax rates, which are lower than ordinary marginal income tax rates as the table below illustrates.

It should be noted that while the long-term capital gains tax rate is lower than the ordinary tax rate, there are other taxes that you might end up paying. The Affordable Care Act of 2010 imposed a 3.8% Medicare surtax on capital gains for single taxpayers with adjusted gross income in excess of $200,000 and married taxpayers filing jointly with adjusted gross income in excess of $250,000.

Wash Sale Rule

Generally, when you sell an asset at a capital loss, you can use that loss to offset other capital gains. There are, however, exceptions. It is worth knowing about the “wash sale” rule in considering whether you will recognize a capital loss.

A wash sale occurs when a taxpayer sells a stock or security and purchases a substantially identical stock or security within a 30-day period before or after the sale. If the sale results in a gain, the wash sale rule doesn’t come into play (the government is fine with you realizing and paying taxes on as many gains as you want). If the sale results in a loss, however, the loss is disallowed. That disallowed loss is added to the basis of the replacement securities purchased.

A couple of examples will help illustrate the wash sale rule. Let’s say that you buy 100 shares of Stock XYZ on January 1 for a total cost of $100. If you later sell all the shares for a total of $90, you will realize a capital loss of $10—provided you don’t buy the stock back within 30 days after you sold it. For example, if you sold it on June 15 and bought the 100 shares back on June 30 for a total cost of $95, the loss would be disallowed, and instead of your cost basis in the stock being $95, it would be $105 (the $95 you paid for it, plus the $10 of the disallowed loss).

Things get trickier when you have more than one tax lot in the stock. Looking at our previous example, if you bought 100 shares of Stock XYZ on January 1 for a total cost of $100, then bought another 100 shares of Stock XYZ on January 30 for a total cost of $95, you would have to wait until more than 30 days had passed from the second purchase before you could realize a loss and avoid a wash sale.

Capital Loss Deduction

As noted, capital gains and losses are categorized as short-term or long-term. Short-term losses are offset against short-term gains, and long-term losses are offset against long-term gains. If the net short-term and net long-term results are either both gains or both losses, no further action is required. If one is a gain and the other is a loss, the net short-term and net long-term results are netted together.

What happens if the result is a net capital loss? In that case, the amount of that loss may be recognized in the current tax year, but it is limited. Under current law, up to $3,000 of net capital losses (either short-term or long-term) may be recognized against other forms of income in any one tax year. If losses exceed $3,000 and the taxpayer has both short-term and long-term losses, the short-term losses are used up first.

Capital Loss Carryover

What happens if you have more than $3,000 in net capital losses in a year? The balance of any losses carries over indefinitely and may be used in a subsequent year. Let’s assume that you have $10,000 in net capital losses in 2023. You could recognize $3,000 of that loss in 2023 to offset other income, carrying over $7,000 to future years. If you had no realized gains in 2024, you could recognize another $3,000 of that loss in 2024, leaving you with $4,000 to carry over. If you then had a $4,000 net capital gain in 2025, you could offset it with the $4,000 loss that you carried over.

How to Get Started

Trying to understand and keep track of capital gains can sometimes be a dizzying experience. By working with a professional financial adviser, they can help keep track of and explain your tax situation and give you clear, objective advice to ensure that your financial goals are met. Find someone that you’re comfortable with and let them help you on your financial journey.