You are now leaving the Chase Investment Counsel website and entering the Chase Growth Fund website.

Divergent Trends Against Rising Stock Prices May Warn of Potential Market Top

Derwood S. Chase, Jr., Founder & Chairman Emeritus, Chase Investment Counsel, Market Commentary

Chase Investment Counsel Corporation uses a “bottom up” investment process combining fundamental analysis (the what) and technical indicators (the when) in making judgements about both market timing and stock selection. We focus on mitigating risk.

Although markets are near record highs, there are some worrisome signs investors should note. The most worrisome negative is the continuing Covid-19 lockdowns which have caused the second worst depression in U.S. history. We expect it will be many years (Congressional Budget Office estimates 2028) before our economy gets back to 2019 levels. Even then, corporate profit margins may not reach2019 levels again, especially if taxes are raised.

Starting on August 11th one of our technical services, Lowry’s Research Buying Power Index began to decline and on August 14th Lowry’s Selling Pressure Index began reversing higher. These divergent trends against rising stock prices typically warn of an approaching market top. Lowry’s historical data back to 1925 suggests that the longer these divergences continue, the more severe any decline may be and the longer a subsequent recovery will take. The probabilities do not yet imply an important top, but do suggest the greater likelihood of a short-term market correction and the need to be more selective and monitor more volatile issues for any technical breakdowns.

The biggest source of buying over the past ten years has been corporate buybacks which are almost absent now. Many of the popular high-multiple tech growth stocks have seen parabolic rises and have become increasingly vulnerable. Investment advisory service bulls are also near historic highs while bears are historically low which suggests a greater risk of a market decline, although historically those sentiment indicators often peak many months before major market tops. Clearly the stock market is ignoring economy. Gold stocks continue to rise, appropriately

responding to the dollar weakness and the risk of hyperinflation caused by the unprecedented $3½ trillion being pumped into the economy. A new factor appears to be speculative buying by millions of inexperienced investors with no memory of the internet bubble decline. That speculation has been exacerbated by Robinhood and other

brokerage firms’ commission-free trading and the new addition of fractional shares to help trade popular high-priced shares.  These newcomers, with entire groups sometimes communicating online, may be helping to bring the mass psychology and risk taking to a whole new level. Based on most historical norms, the market is overbought. Even if we use 2022

These newcomers, with entire groups sometimes communicating online, may be helping to bring the mass psychology and risk taking to a whole new level. Based on most historical norms, the market is overbought. Even if we use 2022

S&P 500 estimates the P/E multiples are well over the 5 and 10-year averages of 16.9 and 15.2, respectively. Still, on a relative value basis with competing alternative investments such as the 10 Year

U.S. Treasury bonds, which yield less than 0.7%, stocks seem relatively attractive.

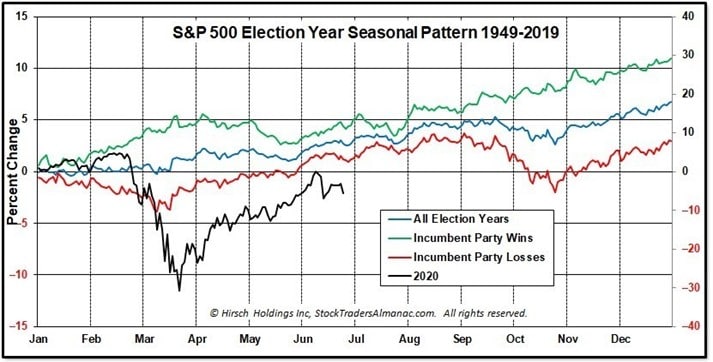

Stock market gains have mostly been the result of excess liquidity, not estimates of improved economic conditions. Investors hate uncertainty and if it begins to look like the Democrats may win the presidency and control of both houses of Congress, a more serious correction may start. In the last 50 years there have been six elections when the ruling party stayed in power. Regardless of which party, the S&P 500 Index was up 100% of the time over the next nine months by an average of 26.5%. However, when the ruling party lost, stocks were only up 50% of the time for an average return of only 0.4%. Our balanced portfolios are conservatively invested with about 65% equities, 35% bonds and cash equivalents. Many companies which we are invested in have continued to have good earnings growth even in a stay-at-home environment, but they are among the most popular fully-priced securities and we are monitoring them closely because they will certainly be affected by any substantial market decline.

_________________________________________________________________________________________