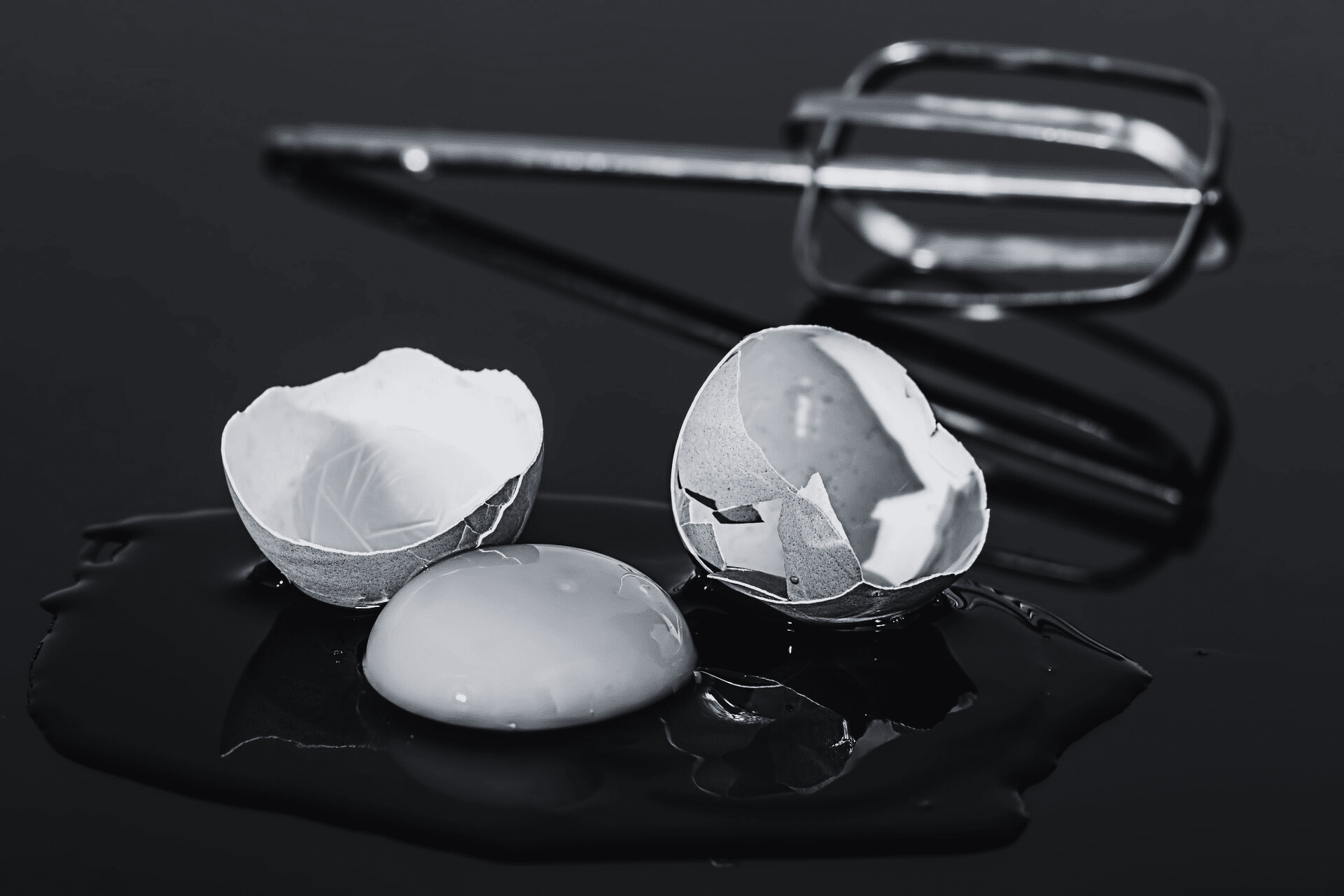

March 2025 Market Commentary: Breaking Eggs

You cannot make an omelet without breaking eggs.

If you can afford them, that is. The quote above Is attributed to Robert Louis Stevenson. The meaning is obvious: accomplishing something worthwhile often causes some pain elsewhere. In short, it is as good a metaphor for today’s equity market as any out there now.

With two weeks to go in Q12025, most of you know that U.S. equity markets have turned around after reaching record highs in mid-February. As of March 14, the S&P 500 Index (“S&P 500”) was 5,638.92, an 8.3% drop from the Feb. 19 high and a 4.1% drop from year-end 2024. The growthier Russell 1000® Growth index is down 8.0% from December 31st while the less-growthier Dow Jones Industrial Index has fallen 2.1% since then. Smaller-cap stocks have suffered more than their larger brethren with the S&P Mid-Cap Index (MID) down 5.9% and the S&P Small-

Cap 600 Index down 9.1%.

If there were a single word to describe the reason for the decline, it would probably be “uncertainty.” A well-known Wall Street adage is that markets hate uncertainty and since the start of the Trump administration in late January, uncertainty has been the word of the day.

Market Commentary and review provided by Peter W. Tuz, CFA, CFP®, President & Director, Portfolio Manager, Chase Investment Counsel.

Read the full Market Commentary.