Market Commentary – April 2019

Derwood S. Chase, Jr., Founder & Chairman Emeritus, Chase Investment Counsel, Market Commentary

Chase Investment Counsel Corporation uses a “bottom up” investment process combining fundamental analysis (the what) and technical indicators (the when) in making judgements about both market timing and stock selection. We focus on mitigating risk.

We used to enumerate the major negatives and positives in these commentaries. However, since the stock market itself is a discounting mechanism for all that information and participants’ reaction to it, we now just concentrate on our market conclusions. Since stock prices are determined by the forces of Supply and Demand we pay particular attention to Lowry’s Primary Trend Perspectives. By April 12, 2019 the S&P 500 Index was less than 1% below its all-time closing high. On April 8th Lowry’s Selling Pressure Index set a new low for the entire bull market from 2009, while their Buying Power Index was at a new rally high. That resulted in a favorable new bull market high in the percent spread between those two indexes. Both the intermediate term and primary uptrends are supported by a continued expansion in breadth by the NYSE all-issues and Lowry’s Operating Company Only (OCO) Advance-Decline Lines. Their Cumulative Net Upside Volume Index also reached a new all time high. Lowry’s concludes that we’re in “a healthy bull market headed for new highs in the weeks and months ahead,” although their short-term indicators are now close to overbought levels.

On April 1st the Dow Transport Index reached a new high which triggered a new Dow Theory Buy Signal. In the late 1960s and early 1970s Richard Russell developed a proprietary Primary Trend Index (PTI), an amalgam of eight critical indicators, which has been very helpful in identifying the major market trends. It has continued to remain positive. We’re in our longest bull market, but it has involved the slowest economic recovery since WWII. GDP growth has been only a third as much as during the other three lengthy post WWII recoveries. From that standpoint, it could continue for quite some time. At 2,706 the S&P 500 was recently selling at about 17 times estimated 2019 earnings, or slightly above its 16½ times five-year average multiple. We are concerned that some stock prices may not completely anticipate slowing 2019 earnings growth much less declining earnings in Q1. FactSet’s consensus of analysts now expect first quarter S&P 500 companies to report a -4.2% decline in earnings and for the whole year only a +3.6% gain. After adjusting for 3.6% estimated corporate share repurchases that would mean earnings per share growth of +7.2%. Most of the estimated declines involve companies in sectors with the highest international revenue exposure: information technology, materials, and energy, reflecting a weaker global economy.

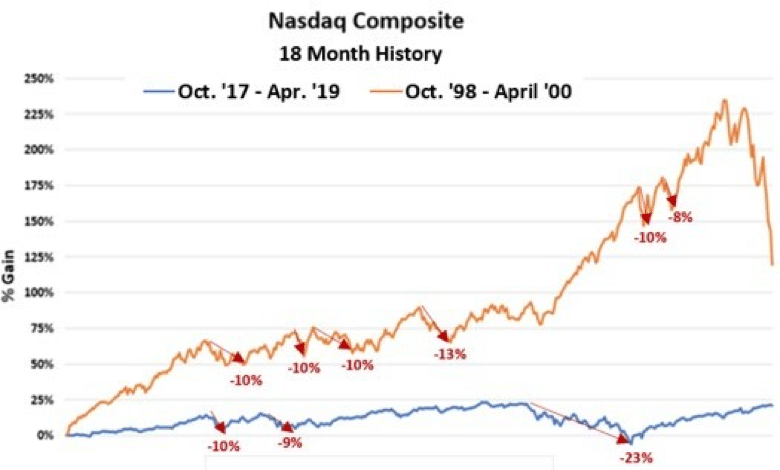

In March the yield curve inverted when the yield on 90-day T-bills rose above 10-year Treasury notes. During the last seven yield inversions recessions started an average of 19 months later, but not before the S&P 500 had risen 19% on average. The last inversion was in January 2006 when the market subsequently rose 26% over the next 21 months to peak in October 2007. So far, we haven’t even had an inversion of the 10 and 2-year bonds which some analysts recognize as a more meaningful inversion. After the September 1998 inversion, the tech heavy Nasdaq Composite Index rose over 230%! (See chart on back.) It now looks like the normal melt up conclusion to long bull markets may finally be starting. Many bearish advisers who thought last year’s correction was the beginning of a bear market keep mentioning various negatives, but most of those negatives do not correlate well with overall market timing. It actually seems healthy that the huge YTD recovery has been able to “climb a wall of worry.”

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). Clearly the last eighteen months has been nothing like previous major bull market conclusions. We try to mitigate risk by avoiding lower quality stocks and limiting the amount of more volatile issues, as well as reducing the emphasis on equities in balanced portfolios when it seems appropriate, which is already conservative for most of our individual clients.

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). Clearly the last eighteen months has been nothing like previous major bull market conclusions. We try to mitigate risk by avoiding lower quality stocks and limiting the amount of more volatile issues, as well as reducing the emphasis on equities in balanced portfolios when it seems appropriate, which is already conservative for most of our individual clients.

Chase Investment Counsel Corporation is the oldest independent investment counsel firm domiciled in Virginia. We’re not in the brokerage business, but act as portfolio managers and purchasing agents for our clients. As Barron’s described us in 1972, we’re located “Far from the Madding Crowd” in Charlottesville, VA. Besides Derwood Chase, we have an excellent “next generation” group of officers that average 49 years of age and over 19 years of experience. Three of us have MBAs, one is a CFA and another is a CMT. We recognize that markets are driven by company fundamentals as well as technical factors which reflect investor sentiment.

In addition to our own research, and that from several brokerage firms, we utilize over 40 independent research sources selected with the benefit of over 50 years experience. Our investment process was developed over more than 50 years and is rather unique in combining fundamental and technical analysis to mitigate risk and build diversified, high quality, reasonably priced growth oriented portfolios. We manage large, mid-cap, and all-cap equity oriented portfolios as well as balanced funds for individuals and trust clients (minimum normally $1 million) in 15 states. We also indirectly serve about 2,500 investors through our mutual fund product. As a smaller firm, we have a particular advantage in managing portfolios since we don’t need huge marketability to acquire or eliminate stock positions promptly without significantly affecting the market. We are not in the brokerage or banking business and do not have the conflicts of interest and the other priorities those businesses involve.