Market Commentary – June 2019

Derwood S. Chase, Jr., Founder & Chairman Emeritus, Chase Investment Counsel, Market Commentary

Chase Investment Counsel Corporation uses a “bottom up” investment process combining fundamental analysis (the what) and technical indicators (the when) in making judgements about both market timing and stock selection. We focus on mitigating risk.

Since stock prices are determined by the forces of supply and demand we pay particular attention to Lowry’s Primary Trend Perspectives. After a worrisome short-term correction which bottomed on June 3rd, the stock market dramatically reversed with a 90% Up Day by Lowry’s Operating Companies Only (OCO) data and a near 90% Up Day in their NYSE all-issues data with those substantial gains supported by expanding breadth as well as Lowry’s Buying Power Index rising back above its Selling Pressure Index on June 4th. By June 13th NYSE all-issues, S&P, and the OCO Large Cap Advance-Decline Lines reached all-time highs. While that may leave the market short-term overbought and subject to a near-term correction, especially if the Federal Reserve doesn’t reduce short-term interest rates on Wednesday, June 19, 2019, Lowry’s believes the probabilities now favor new all-time highs in the weeks ahead and a renewal of the intermediate market uptrend.

We are already in the seasonally weak six months (May – October) for the Dow 30 and the S&P 500 index and soon enter the seasonally weak four months (July – October) for the Nasdaq. That tends to favor a range bound market over the near term with some sector rotation. 43.6% of the sales by S&P 500 companies are abroad. According to FactSet, multi-nationals with greater than 50% of sales outside the U.S. had 1st quarter earnings decline of -12.8% reflecting weak foreign economies and exchange losses against our strong dollar. FactSet now estimates those multi-nationals will have a -9.3% earnings decline in the second quarter. They have the most to lose from a sustained trade war, particularly some of the technology companies. The Information Technology sector is expected to report the highest (year-over- year) earnings decline of all eleven sectors at -12.6%, with the semiconductors and semiconductor equipment the worst (-32%) at the industry level. Normally technology has been one of the four best performing sectors along with health care, consumer staples, and utilities during the seasonally weak May – October period based on 1990–2018 performance.

We remain concerned that individual stock prices may not completely anticipate some earnings declines and overall slowing 2019 earnings growth. However, as of June 12th with the percentage of S&P 500 stocks trading above their respective 200-day moving averages, and the S&P 500 also above its 200- day moving average, it has been higher six months later 79% of the time for a median return of 5.72% since 2010. We believe in the maxim “Don’t Fight the Fed.” The market already seems to be partly discounting a rate cut by the Federal Reserve this Wednesday and may prove to be short-term overbought, especially if they don’t. Short-term weakness would be a buying opportunity. We continue to monitor a number of factors for any significant deterioration, but we continue to believe this bull market will not end until we have the normal “melt up” conclusion.

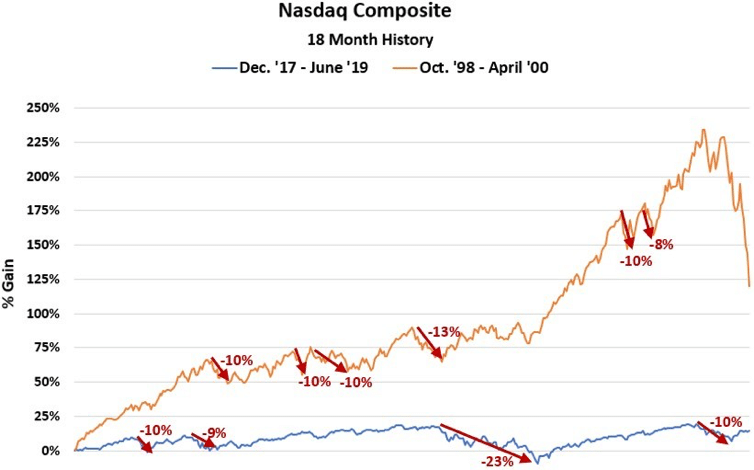

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). Clearly the last eighteen months has been nothing like previous major bull market conclusions. We try to mitigate risk by avoiding lower quality stocks and limiting the amount of more volatile issues, as well as reducing the emphasis on equities in balanced portfolios when it seems appropriate. Asset allocation is already conservative for most of our individual clients.

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). Clearly the last eighteen months has been nothing like previous major bull market conclusions. We try to mitigate risk by avoiding lower quality stocks and limiting the amount of more volatile issues, as well as reducing the emphasis on equities in balanced portfolios when it seems appropriate. Asset allocation is already conservative for most of our individual clients.

Chase Investment Counsel Corporation is the oldest independent investment counsel firm domiciled in Virginia. We’re not in the brokerage business, but act as portfolio managers and purchasing agents for our clients. As Barron’s described us in 1972, we’re located “Far from the Madding Crowd” in Charlottesville, VA. Besides Derwood Chase, we have an excellent “next generation” group of officers that average 49 years of age and over 19 years of experience. Three of us have MBAs, one is a CFA and another is a CMT. We recognize that markets are driven by company fundamentals as well as technical factors which reflect investor sentiment.

In addition to our own research, and that from several brokerage firms, we utilize over 40 independent research sources selected with the benefit of over 50 years experience. Our investment process was developed over more than 50 years and is rather unique in combining fundamental and technical analysis to mitigate risk and build diversified, high quality, reasonably priced growth oriented portfolios. We manage large, mid-cap, and all-cap equity oriented portfolios as well as balanced funds for individuals and trust clients (minimum normally $1 million) in 15 states. We also indirectly serve about 2,300 investors through our mutual fund product. As a smaller firm, we have a particular advantage in managing portfolios since we don’t need huge marketability to acquire or eliminate stock positions promptly without significantly affecting the market. We are not in the brokerage or banking business and do not have the conflicts of interest and the other priorities those businesses involve.