You are now leaving the Chase Investment Counsel website and entering the Chase Growth Fund website.

Market Commentary – Sept 2019

Derwood S. Chase, Jr., Founder & Chairman Emeritus, Chase Investment Counsel, Market Commentary

Chase Investment Counsel Corporation uses a “bottom up” investment process combining fundamental analysis (the what) and technical indicators (the when) in making judgements about both market timing and stock selection. We focus on mitigating risk.

The media keeps emphasizing negatives related to the economic outlook: recent decline in manufacturing activity, for the first time since 2007, in August the 10 year and 2 year Treasury yields inverted, trade conflicts, geopolitical uncertainties, and consumer debt at all time high over $4 trillion. The American Association of Individual Investor’s survey indicates investors are more bearish now than they were in 2009 during the financial crisis! Many of the negatives are short-term, others just don’t correlate with the stock market. The yield inversion does correlate, but it’s only an early warning indicator. Stocks have usually risen substantially for twelve months or so after inversions. While consumer debt is at a peak, more important is the fact that payment on consumer debt as a percentage of disposable income has improved from 13% in 2008 to less than 10% or close to the lowest level since 1980.

Since stock prices are determined by the forces of supply and demand we pay particular attention to Lowry’s Primary Trend Perspectives. From early August major market indexes have been confined to rough trading ranges which the forces of Supply and Demand suggested would be resolved by a renewed market rally. The bottom of the trading range was defined by three declines, each ending at about the same level. Each of these three declines was on Down Volume of 90% or more of total Up/ Down Volume, suggesting the potential exhaustion in Supply. Each of these declines was followed by signs of renewed Demand, either through an 80% Up Day, a 90% Up Day, or consecutive 80% Up Days. The combination of heavy selling (90% Down Days) followed by signs of renewed, strong Demand is a classic pattern suggesting that stocks were undergoing a process of accumulation in anticipation of an eventual breakout into a rally. Simultaneously NYSE all-issues and Lowry’s Operating Companies Only (OCO) Advance-Decline Lines both produced all-time highs which historically has been followed by new highs in the major indexes. During the last few weeks small cap stocks whose weakness in much of the third quarter had been acting like an early warning to a faltering bull market have started outpacing the gains of both large and mid-cap stocks and instead now suggest an impressive rejuvenation of the bull market. Overall Lowry’s believes the probabilities favor the bull market remaining alive and well.

We are now in the May-October seasonally weak six months for the Dow 30 and the S&P 500® indexes, July-October for the Nasdaq. According to FactSet, S&P 500® companies with greater than 50% of sales outside the U.S. will continue to have earnings declines estimated at –10.7% in Q3 reflecting slowdowns in foreign economies and exchange losses against a strong dollar. We remain concerned that individual stock prices may not completely anticipate further earnings declines and overall slowing of 2019 earnings which could contribute to a short term correction. The market already seems to be discounting a 0.25% rate cut by the Federal Reserve this week and may prove to be short-term overbought and vulnerable to a further correction in October.

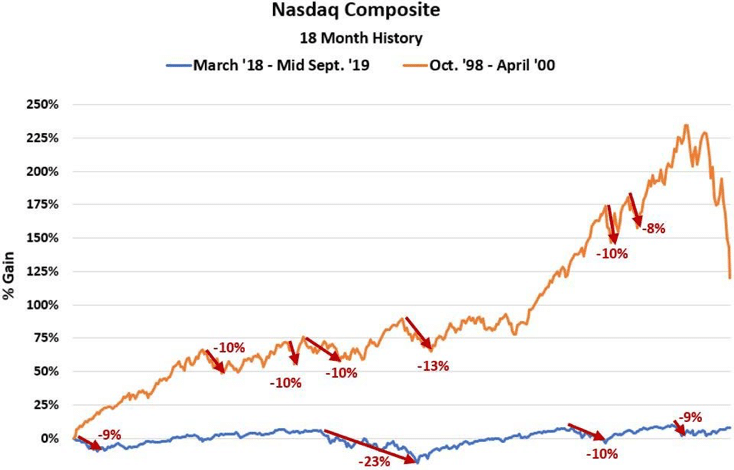

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). We continue to believe this bull market will have something like a normal “melt up” before its over especially with bonds selling at very unattractive low yields making stocks much more attractive.

We’ve updated the adjacent chart which compares the last 18 months of a typical major bull market (orange line) with the latest 18 months (blue line). We continue to believe this bull market will have something like a normal “melt up” before its over especially with bonds selling at very unattractive low yields making stocks much more attractive.

Chase Investment Counsel Corporation is the oldest independent investment counsel firm domiciled in Virginia. We’re not in the brokerage business, but act as portfolio managers and purchasing agents for our clients. As Barron’s described us in 1972, we’re located “Far from the Madding Crowd” in Charlottesville, VA. Besides Derwood Chase, we have an excellent “next generation” group of officers that average 49 years of age and over 19 years of experience. Three of us have MBAs, one is a CFA and another is a CMT. We recognize that markets are driven by company fundamentals as well as technical factors which reflect investor sentiment.

In addition to our own research, and that from several brokerage firms, we utilize over 40 independent research sources selected with the benefit of over 50 years experience. Our investment process was developed over more than 50 years and is rather unique in combining fundamental and technical analysis to mitigate risk and build diversified, high quality, reasonably priced growth oriented portfolios. We manage large, mid-cap, and all-cap equity oriented portfolios as well as balanced funds for individuals and trust clients (minimum normally $1 million) in 15 states. We also indirectly serve about 2,300 investors through our mutual fund product. As a smaller firm, we have a particular advantage in managing portfolios since we don’t need huge marketability to acquire or eliminate stock positions promptly without significantly affecting the market. We are not in the brokerage or banking business and do not have the conflicts of interest and the other priorities those businesses involve.