Technical Indicators Confirm the Likelihood of Continuing Upward Trend in Market

Derwood S. Chase, Jr., Founder & Chairman Emeritus, Chase Investment Counsel, Market Commentary

Chase Investment Counsel Corporation uses a “bottom up” investment process combining fundamental analysis (the what) and technical indicators (the when) in making judgements about both market timing and stock selection. We focus on mitigating risk.

During the recent market correction there was little evidence of deterioration in breadth or momentum. In fact, since the S&P 500 Index low on September 23rd small and mid-cap stocks outperformed the S&P for over a month, unusual for a major topping process. Then, on November 3rd, the market had two consecutive 80% Upside Days which registered a Lowry’s Analysis short-term Buy Signal and confirms an intermediate uptrend. A number of other technical indicators have also confirmed the likelihood of a continuing upward trend. Eight of the past nine Presidential elections prior to this one resulted in rises between 8% and 37% from election day to the end of the next year. On November 3rd, the Stock Trader’s Almanac issued their Buy Signal for the beginning of the seasonally favorable six months. The market now expects the Senate to remain controlled by the Republicans holding a 52-48 or 51-49 seat majority. That would reduce the potential for extreme policy changes like proposed tax hikes, health care and green wave spending or other big increases in fiscal spending. If that expectation proves wrong, the uncertainty could result in a significant correction.

The economy continues to recover. Housing remained strong in October with builder confidence, traffic expectations, sales expectations, starts and permits all at or near record levels. Combined with record low interest rates this should keep demand strong as the pandemic has placed a renewed importance on homes.

The likelihood of a Covid vaccine by early next year along with the high level of pent up demand and savings accumulated during the pandemic bodes well for a strong economy in 2021-2. Corporate earnings should continue to improve in 2021 and the Federal Reserve plans to continue their highly accommodative monetary stimulus with the hope of stimulating economic growth of 3½% or more. Excess liquidity could push the stock market significantly higher especially with little competition from low yielding fixed income investments.

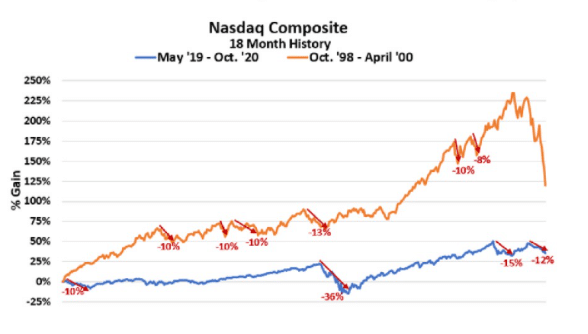

The adjacent Nasdaq chart compares the last 18 months of a typical major bull market (orange line) with the latest 18 months through October 2020 (blue line). We still expect this bull market, delayed by the pandemic, will continue its “melt up” similar to most others. Nasdaq tech stocks have certainly started. We continue to believe that for the long-term good quality growth stocks, including some cyclical growth companies such as major infrastructure beneficiaries, offer the most potential. Large tech-oriented companies in Artificial Intelligence (AI) sectors as well as information and communication services (5G), payment processing, and health services should be among the best performers. Generally, companies with high profit margins that require little need for additional investment capital to grow rapidly, should continue to offer good returns. Ideally, we look for companies with repeat business that is protected by patents or some particular advantage over competitors and which have adequate trading liquidity to accommodate institutional investors. Many of these stocks are very fully priced which makes them vulnerable to any significant market correction. We are cushioning that risk with diversification and by maintaining about 35% emphasis on short-term high-quality bonds and cash equivalents in our balanced portfolios.

The adjacent Nasdaq chart compares the last 18 months of a typical major bull market (orange line) with the latest 18 months through October 2020 (blue line). We still expect this bull market, delayed by the pandemic, will continue its “melt up” similar to most others. Nasdaq tech stocks have certainly started. We continue to believe that for the long-term good quality growth stocks, including some cyclical growth companies such as major infrastructure beneficiaries, offer the most potential. Large tech-oriented companies in Artificial Intelligence (AI) sectors as well as information and communication services (5G), payment processing, and health services should be among the best performers. Generally, companies with high profit margins that require little need for additional investment capital to grow rapidly, should continue to offer good returns. Ideally, we look for companies with repeat business that is protected by patents or some particular advantage over competitors and which have adequate trading liquidity to accommodate institutional investors. Many of these stocks are very fully priced which makes them vulnerable to any significant market correction. We are cushioning that risk with diversification and by maintaining about 35% emphasis on short-term high-quality bonds and cash equivalents in our balanced portfolios.