You are now leaving the Chase Investment Counsel website and entering the Chase Growth Fund website.

Preparing for Retirement: Housing

One of the biggest assets most of us will end up with as we near retirement will probably be our home. What you decide to do with it as you retire is probably one of the more important decisions you will make. Chances are reasonably high that you have lived in this home for many years, you have raised your family there and you have significant emotional attachment to it. You may still have a mortgage. You may not. It may be more “house than you need.” Or it may be located in a high-tax area. Or it may be located far from other family members. This note is designed to make you think about these issues. It is not meant to be an all-comprehensive guide to the issue of housing and moving in retirement.

Stay or go:

The first decision regarding housing as one nears or reaches retirement sounds simple: should we stay here, or should we move? Like many things that seem simple at first, this question brings with it many complexities. It raises several questions including the following:

Is it “too much house” for us as we age?

Is the home appropriate for us as we age?

Is it in the right location?

Can we use the equity we may have built up in the home over the years for other purposes?

All of these questions are very subjective in nature. Many of us will have no interest in “downsizing,” some of us might even “upsize” to the home of their dreams. But chances are fairly high that the home we raised our family in will be more house than we need in several ways. It might simply be too big for two people instead of two people and children. It might have a lot of property that comes with it. And with that property comes upkeep such as yard care that may become more difficult, if not more costly as well, as we age. In addition, selling has its costs including commissions to real estate salespeople, which often average 5%-6% of a home’s sales price, plus whatever repair costs that would be made prior to a sale.

A closely related question is whether the home is “appropriate” for us as we age. The most obvious example would be the location of the master bedroom and bath. Is it on a ground floor, or does it require a climb up a flight of stairs to get to it? Related to this is the question of whether the house can be, and is worth, remodeling so there is a ground floor bed and bath? There are a lot of home designs these days that emphasize one-level living for people as they age. There are many other “senior friendly” features that may be added to increase one’s comfort as they age.

What type of housing to choose:

Depending on one’s age, health and interests, and budget after the decision to move is made and the location where to move is decided, what type of housing to move into comes next. The choice could be a smaller home, or it could be a larger home, but offering one-floor living. It could be a traditional single family detached house, a townhouse, a condominium, or one of the several types of “senior housing” now available and popular in many parts of the country. A recent Wall Street Journal article identified five types of senior housing. They include:

Active adult communities: generally restricted to people 55 and over, these may include both single-family homes and various multi-family dwellings and might include both properties to purchase and to rent. Amenities are often stressed at these locations.

Independent Living Facilities: these are usually apartments or single-family homes reserved for people who need minimal or no assistance, but which offer various hospitality and support services to those who want them. These facilities may require an entrance fee, or may be rental properties. Often a monthly fee for various services and amenities is required.

Assisted living: these typically offer a combination of independent housing and various support services and care its residents may need, including help with daily activities such as eating, bathing, and dressing. Residents usually pay a combination of rent and fees for various services.

Skilled nursing facilities: this category typically includes nursing homes offering living facilities and 24-hour help with all normal daily living activities. They are usually paid for by monthly fees that include meals, and most medical and personal assistance.

Memory care facilities: these are similar to skilled nursing facilities but specialize in helping residents with dementia, Alzheimer’s or other types of cognitive impairments.

Quite often senior housing communities are a combination of several types of housing and care levels. One facility may offer independent living, assisted living, skilled nursing and memory care depending on the needs of a resident with the resident having the ability to move to the next level of housing as needed. It is typical for these facilities to charge a one-time fee to enter and monthly fees to cover the various other services as needed. The entry fee, the other fees, and the rules on moving to more appropriate housing as needed, should be researched carefully before choosing this type of facility.

There are a lot of resources available to people researching various choices in senior housing. Publications such as the Wall Street Journal and Kiplinger’s frequently have articles on the subject and organizations such as A.A.R.P. have a lot of information on the subject on their web sites.

Where to live:

Obviously one of the key decisions individuals or couples nearing or in retirement may make will be whether to move. This includes many choices. Some of us might want to retire to the country, the beach or the mountains. Others might want to retire to an urban area to take advantage of the cultural offerings that might be available there. Others might want to retire to an area closer to children, grandchildren or other family members. These are all personal choices with no “right” answers.

There are financial advantages, however, in some choices about where to retire, basically concerning taxes. Retiring in a place with low taxes may make for a better retirement. As of May, 2021, there are nine states with no state income taxes: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming. Three other states (Illinois, Mississippi and Pennsylvania) don’t tax distributions from 401K plans, IRAs or pensions. Beyond that, there are various tax rules in many states that affect retirement income. Military pensions, for example, are not taxed in 20 states. Some other states only partially tax military pay. Virginia only allows Congressional Medal of Honor winners to exclude military pension income from taxes.

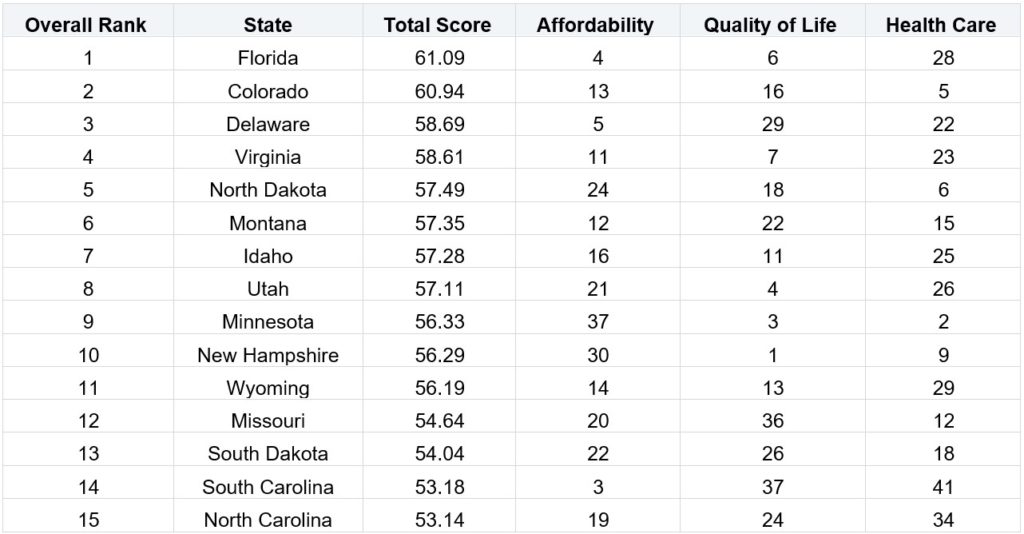

An interesting “where to retire” guide can be found at Wallet Hub’s “Best Places to Retire” site. Using more than 40 criteria, it ranked states and cities as to attractiveness. Florida, not surprisingly, got the top ranking. The other top 15 are listed below.

Source: WalletHub.com

Financing your new dwelling:

When we are thinking of moving into some type of retirement dwelling, most of us probably think of selling one home and buying another. This may be the right decision, but it may prove wise to think first of whether you should buy or rent your next dwelling and if you buy, should you try to pay the entire purchase price or is a mortgage warranted.

Think about some of the possible scenarios in moving: you sell your existing house for $1 million, you buy a new one for $500,000. You now have $500,000 for other living expenses or investments

You sell your existing house for $1 million and you rent for $5,000 per month, or $60,000 per year. Some or all of that $1 million can be invested. There are four key factors in deciding whether to rent or buy and whether to use financing for your new dwelling. They include:

What rate you can reasonably expect your new house to appreciate at over the time you live there?

What initial rent might be and what percentage it might increase at each year?

What return can you reasonably expect should you invest home sale proceeds?

What mortgage rate can you get today should you choose to finance a new home?

There are too many combinations of these variables to offer a “right” answer.

Read Next: HEALTHCARE IN RETIREMENT

About Chase Investment Counsel

Chase Investment Counsel is a family and employee-owned boutique wealth management firm that offers personalized investment services. Our clients include career professionals, those nearing or in retirement, and families experiencing financial transitions such as generational wealth transfer, widowhood, divorce or sale of a business. Chase’s active, disciplined investment management team is focused on selecting individual stocks and bonds targeted to each investor’s specific financial goals and risk tolerance. Established in 1957 in Charlottesville, VA, Chase Investment Counsel manages approximately $300 million in assets.